Congratulations! You have finally closed on your home loan, and you are excited to get moved in. Or, you may have just refinanced your home, and you are excited to enjoy it. Regardless, all of a sudden, you start to get a bunch of junk mail in your mailbox. It can be frustrating to sort through everything, and how did they get your information in the first place?

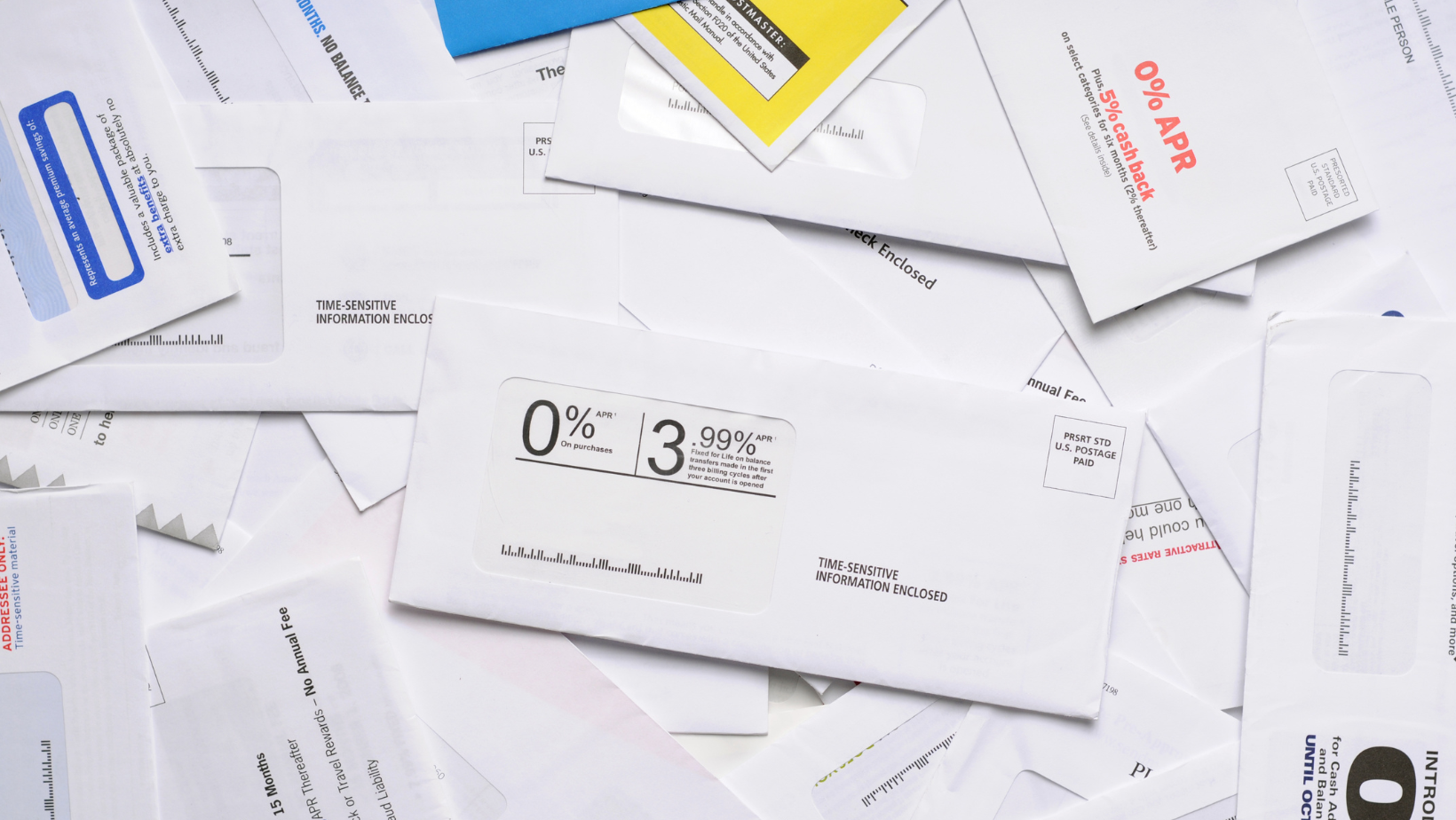

Congratulations! You have finally closed on your home loan, and you are excited to get moved in. Or, you may have just refinanced your home, and you are excited to enjoy it. Regardless, all of a sudden, you start to get a bunch of junk mail in your mailbox. It can be frustrating to sort through everything, and how did they get your information in the first place?

Where Junk Mailers Get Your Personal Information

First, there are a few locations where junk mailers may have gotten your personal information. Once your property deed is recorded, it goes into the public record. Anyone who goes into the public record can find your name, the name of your lender, your loan amount, and your address. This is what they use to send you junk mail, and it is why you get flooded with a bunch of mail as soon as you close on a home loan.

Always Check Your Mail Before Shredding It

Even though you are going to receive a lot of junk, some of it is going to have your personal information listed on it. You should always check to see if your personal information is on the mail, and if it is, go ahead and shred it. On the other hand, you must make sure you do not throw out anything important. For example, there might be a note about property taxes, or there might be information related to changes in your loan. Always screen your mail before you shred it.

Can You Stop The Junk Mail?

It is unlikely that you will be able to stop the junk mail completely. On the other hand, there are a few locations where you might be able to opt out of some of this junk mail. If you put yourself on the do not mail registry, you may be able to reduce the amount of junk mail you receive.

Talk To A Professional To Learn More

You need to understand exactly what is happening with your home loan before you close, and that is why you should reach out to an expert who can help you. They might even be able to provide you with some advice regarding how you can stop the junk mail from coming in.